Synopsis:

Data-driven decisions: the cornerstone of future growth

AI, IoT, and automation: powering the agricultural ecosystem

Deepening farmer engagement: building trust and transparency

Building trust and transparency with farmers emerged as a key benefit of digitization across all three segments. Notably, 62% of seed producers believe digitalization can overhaul current engagement practices and build trust with farmers. Conversely, 88% of food processors identified consistent farmer engagement as a major challenge. Similarly, 82% of crop protection respondents consider enhancing farmer engagement a primary challenge.

Embracing change management and continuous improvement

The seed industry: embracing digitalization for a sustainable future

Sowing seeds of digitalization

Digitalizing the seed value chain

- R&D: Eighty percent of participants believe that leveraging digital tools can reduce R&D costs, while 72 percent feel it can accelerate trialing. The biggest benefit for 65 percent of participants is having a single-point system tracking the progress of each seed variety.

- Production: Seed companies have established ambitious goals to be achieved with digitization. The survey shows that 80% of participants aim to enhance monitoring practices to improve yield and quality, and 75% target improvement in field audit, seed demand estimation, and supply. Further, 65% of participants look to improve the ease of configuring the package of practices based on crop, variety, region, and time of year, supported by digitization efforts.

- Sales & marketing: They are looking to improve transparency and visibility into progress made for each crop/variety globally (72%), create customized sales strategies for different geographies (70%), and run farmer engagement campaigns and monitoring activity for each demo plot (68%) as the top business benefits resulting from the digitization of processes.

Data as a strategic asset

The rise of advanced technologies

Empowering farmers

- Develop targeted training programs for smallholder and women farmers (currently, only 12% offer dedicated programs).

- Collaborate with farmers to ensure their integration into the knowledge chain and benefit from industry advancements.

- 90% of the participants agreed that they must overhaul their farmer engagement practices.

A Sustainable future

- Increase efficiency and productivity.

- Develop sustainable and climate-resilient seed varieties.

- Empower farmers for improved livelihoods and global food security.

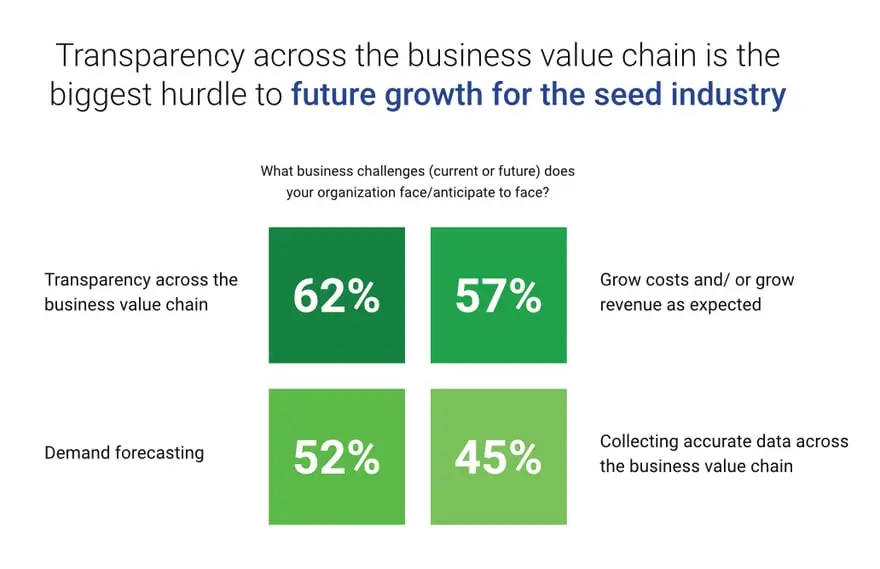

Top challenges for seed industry

Shortage of digital talent is a reality Companies finding digital talent as an issue in meeting their digital goals

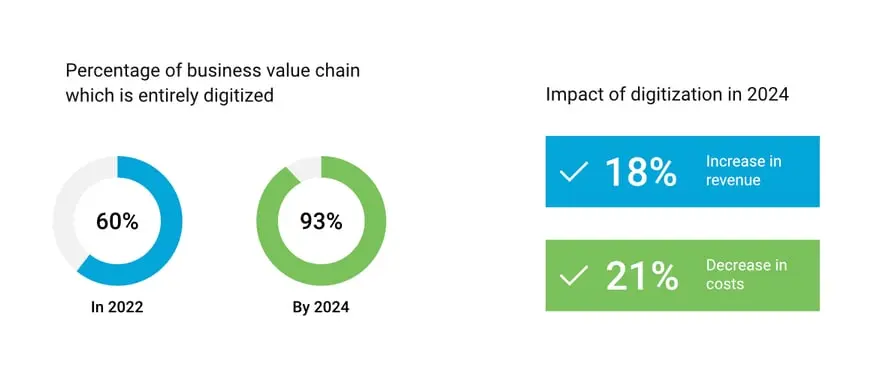

Digital as a driver to reduce costs

Decrease in costs as a result of digitizing

the business in 2024

Al and automation are yet to become core to digitization Companies have done the widespread implementation of Al

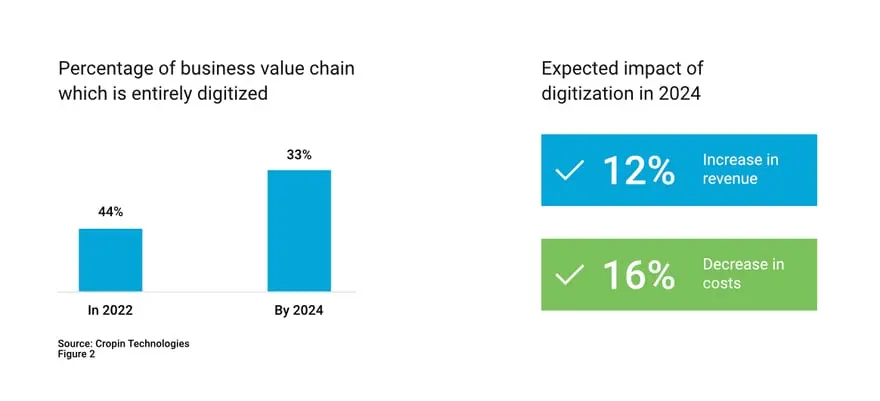

Digitizing the entire business value chain for future growth Of business value chain to be digitized by 2024, up from 47% today

Establishing the data supply chain is the biggest opportunity Data silos across the business units slowing down the pace of digitization automation firms

The real power of seed lies in data of data will be analyzed by 2024, up from 37% today, registering a growth of 116% in analyzing data

The rise of advanced technologies

Digitalization: the engine of growth

- Procurement: A significant 88% have their sights firmly set on deepening farmer engagement with digital tools, and 78% look at it to improve accuracy in forecasting.

- Supply chain: Of the supply chain respondents in the sector, 85% see challenges in end-to-end visibility, 81% in gaining consumer trust, and 78% in controlling the timing, quality, and quantity of supply to demand, fostering customer loyalty. They expect significant progress around traceability in agriculture with the implementation of digital technologies.

- Sales & marketing: Digital investments in the downstream value chain can provide real-time insights to meet evolving consumer demands for sales & marketing. Lack of intelligence from the field, customers, retailers, and dealers is a key challenge for 81% of respondents.

From data to decisions

The rise of digital technologies

Food processors are increasingly leveraging various technologies, including:

Challenges and considerations:

- Digital Talent Shortage (54%): Need to attract young talent to bridge the skill gap.

- Localization (58%): Developing solutions that cater to diverse market regulations, preferences, and needs is crucial.

- Workflow Customization: Ensuring digital solutions adapt to specific business models and processes is essential for successful implementation.

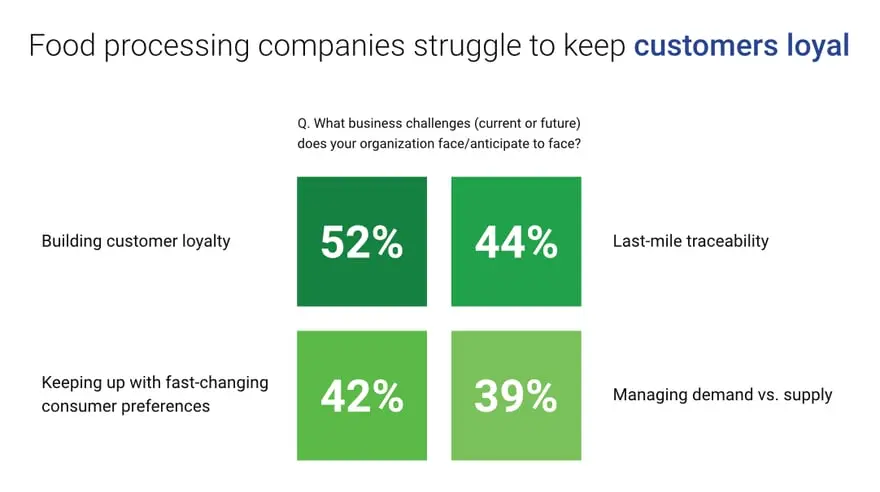

Top challenges for food processing companies

Shortage of digital talent is a reality Companies finding digital talent as an issue in meeting their digital goals

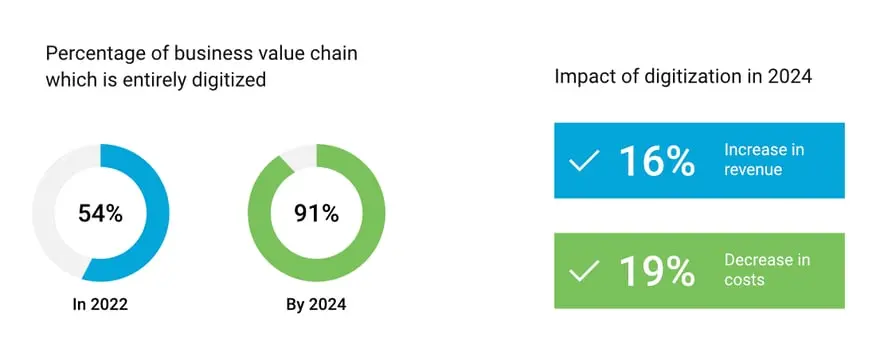

Huge cost savings opportunities

Decrease in costs as a result of digitizing the business in 2024

Al and automation are yet to become core to digitization Companies have done the widespread implementation of Al & automation

Digitizing the entire business value chain for future growth Of business value chain to be digitized by 2024, up from 47% today

Establishing the data supply chain is the biggest opportunity Are keen to adopt a single platform that manages to entire lifecycle of data

Data: The next battleground for digital success Of data will be analyzed by 2024, up from 45% today

The digital future of crop protection: embracing technology for a sustainable and efficient industry

Challenges and pressures

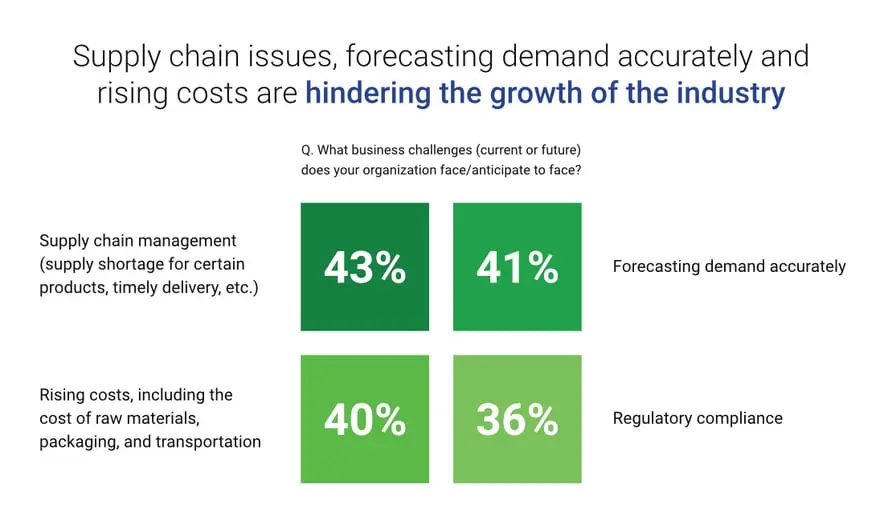

- Supply chain disruptions: Respondents from the crop protection industry identified supply chain management (43%) as the biggest challenge, followed by accurate demand forecasting (41%) and rising costs (40%). Lack of visibility across the entire supply chain further exacerbates these issues, making it difficult to manage resources effectively.

- Demand forecasting complexities: The industry’s cyclical nature and fluctuating sales make accurate demand forecasting challenging. Predicting long-term trends is even more difficult, considering the constant development of new products and applications.

Benefits of digital transformation

Digital transformation across the value chain

Data management and utilization

Emerging technologies

Challenges and considerations

- Breaking down business silos (41%) through cross-functional teams.

- Addressing the digital talent shortage (38%) through partnerships.

- Lack of workflow customizations (35%) to cater to diverse market needs.

A Sustainable future

Digital transformation is essential for the crop protection industry to ensure a secure and sustainable future. By leveraging technology, companies can:

- Reduce crop loss from pests and diseases.

- Improve demand forecasting.

- Manage resources effectively, minimizing environmental impact.

- Enhance food security and meet the growing global demand for food.

Top challenges for food processing companies

Shortage of digital talent is a reality Companies saying finding digital talent as an issue in meeting their digital goals

Digital also means cutting costs

Decrease in costs as a result of digitizing the business in 2024

Al and automation should form the digital foundation Companies have done the widespread implementation of Al & automation

Open new growth oppertunities Of business value chain to be digitized by 2024, up from 60% today

Establishing the data supply chain is the biggest opportunity Don't have centralized data platform to access data across departments

Data could make or break the future data silos across the business units slowing down the pace of digitization in organizations

Conclusion

- Invest in Technology to Digitalize Operations.

- Align Vendors with Your Long-term Strategic Goals.

- Prepare for the Adoption of AI, IoT, and Automation.

- Devise a Fool-Proof Change Management Strategy.