Need for agri-insurance among smallholder farmers

About 84% of the 570 million farms globally belong to smallholder farmers, who cater to anywhere between 70%-80% of the world’s food needs. Smallholder farmers are constantly threatened by financial uncertainties caused by natural calamities that are beyond their control. Climate change is the biggest cause for this uncertainty. Frequent extreme weather events and growing occurrences of pests and diseases are increasing financial losses for farmers in developing countries, affecting their livelihood.

This makes smallholder farmers the most vulnerable lot who need support. How can support be provided? Well, farmers can manage risks with agricultural insurance that offers them financial protection against uncertainties causing crop failures/losses like drought, disease, excessive moisture, frost, flood, hail, wind, wildlife, etc.

- Greater financial security

- Complete protection for the farmer and their family

- Improved access to loans from financial institutions

- Peace of mind with complete protection

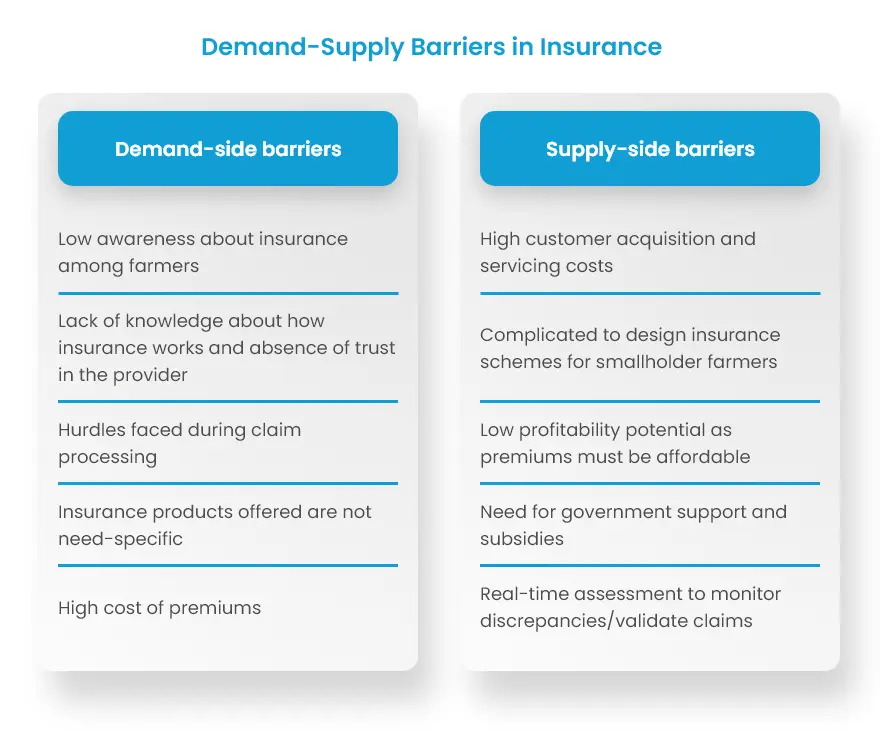

Globally, only below 20% of smallholder farmers are covered by insurance that protects them from natural calamities. The gap in insurance coverage is attributed to the demand-supply mismatch, as depicted in the figure below.

Challenges faced by agri-insurance companies

Various challenges encountered by the agri-insurance companies include:

- Risk variability

- Agribusiness Liability

- Farmer and claim verification

- Lack of plot-level and regional-level insights

- Need for real-time accurate crop loss assessments

- High operational costs