We live in a fast-paced advanced era where the world embraces technical supremacy in agriculture and associated domains. Unfortunately, small-holding farmers have yet to see the better half of the spectrum. It is primarily due to their use of age-old traditional agricultural practices, coupled with the risks imposed by climate change and the lack of financial support.

Undeniably, an agriculture loan is imperative for farmers to achieve a fruitful yield. It makes it possible for them to invest in and maintain the agricultural land, purchase high-quality inputs, such as seed and agrochemicals, allocate funds to acquire farm tools and machinery, and the like. Equally important is availing of crop insurance to ensure financial protection in the event of crop failure.

As such, agriculture loans are now more essential than ever. Even governments worldwide encourage banks to extend adequate credit options to farmers. With that in perspective, let us look at the many advancements in the agri-lending domain and how technology can help overcome the hurdles.

The Indian Agri-Lending Landscape

Agriculture and its allied sectors combined contribute approximately USD 368 billion to the economy, and yes, it is up for total tech-based disruption. Here are some of the salient factors associated with this domain, which further establish why tech-enabled agriculture loan is the need of the hour:

- Close to 55% of the Indian population depends on agricultural and allied sectors.

- The same sectors contribute about 16% to the economy.

- Also, the allocated interim budget for these sectors, as of 2019-20, was a staggering USD 21 billion.

On the flip side, only about 30% of the farmers can borrow from commercial banks and other formal lending institutions. Besides, 50% of the marginal and small farmers are unable to borrow from any source at all. Also, interestingly, USD 168 billion of agricultural credit was provided by banks in FY18-19. However, only 50% of the credit was made available to the large- and medium-scale farmers.

What this information translates to is that banks are reluctant to offer credit options to small and marginal farmers, primarily due to the following reasons:

- Poor access and difficulty to reach remote areas

- Unpredictable policy environment

- Limited information

- The perceived high risk of default due to the unpredictable nature of the sector

- The adhering exorbitant cost of servicing and acquisition for small and marginal farmers or SMFs

The challenges to agri-lending will be explored in detail in later sections, besides understanding how technology can help overcome such issues and accelerate crop loan disbursal for small farmers [jump to section].

What Is the Entire Buzz About Priority Sector Lending (PSL)?

Priority sectors are those predetermined by the Government of India and the Reserve Bank of India (RBI) for priority financial assistance. These sectors include activities of national importance and are assigned priority for development. They are critical to meeting the basic needs of the country’s population, and a lack of timely credit could lead to heavy losses to the participants of that sector in some cases.

In short, priority sector lending is for the deserving yet deprived sectors of the economy instead of supporting only profitable sectors.

What Was the Need for Priority Sector Lending?

During the early post-independence era, agriculture was in dire need of financial assistance. Although it was the primary sector of the economy, banks were unwilling to extend credit due to several factors. Further, with the ushering of the Green Revolution, farmers and the cooperative societies required additional credit, which the State Bank of India could not manage to meet.

A series of events beginning in July 1966 paved the way for the concept of directed lending, or priority sector lending as it is known today. Over the years, the RBI has made several changes in priority sector lending, adding other sectors and modifying the scope of targets and sub-targets applicable to the various bank groups.

The PSL scheme can also be considered a paradigm prerequisite to getting hold of allocational efficiency in the economy.

What Is the Core Philosophy of PSL?

The PSL scheme revolves around the understanding that credit flow to the distressed sectors, which are also creditworthy and viable, may not be timely and adequate due to this special dispensation. The initiative also focuses on weaker fractions of the society and those segments of the economy that promise higher employment potential and, thereby, poverty alleviation.

As a result, the shift in national priorities to lend to vulnerable economies has increased employability, created basic infrastructure, and improved their competitiveness, thus creating more jobs.

PSL is not a corporate social responsibility. Instead, it is a standard business operation for banks. The PSL scheme also encourages banks to develop multiple creative structures, products, and the many processes that can streamline credit to these financially handicapped sectors. The idea is to lend directly to the farmers and other eligible beneficiaries and avoid rerouting these agriculture loans through intermediaries.

Consequently, PSL uplifts the weaker sector which the market forces frequently fail to do. Directed lending via PSL enables commercial banks to engender high social returns together with profits. By expanding investment in the strategic sectors, PSL further promotes social equity, facilitates an increase in employment, and contributes to economic development among the less developed regions and vulnerable sections of society. In addition, it helps reduce the dependence of specific categories of borrowers on informal moneylenders who charge high rates of interest.

Agriculture, small industries, and self-employment were the sectors that initially benefited from directed lending. In 2016, RBI updated its categories under PSL to include the following eight:

- Agriculture

- MSME (Micro, Small, and Medium Enterprises)

- Export credit

- Housing

- Education loan

- Renewable energy

- Social infrastructure

- Others

Notably, agriculture credit alone makes up about 18% of the PSL target and includes 8% for small and medium farmers.

The agriculture target of PSL is inclusive of the following objectives:

- Domestic banks must ensure that the overall lending percentage to farmers from non-corporate backgrounds does not fall below the system-wide average of the last three years.

- Also, they must dedicate efforts to assuring 13.5% of Adjusted Net Bank Credit (ANBC) to the beneficiaries who were previously a part of the direct agricultural sector.

Categories of PSL Lending Options in Agriculture

PSL lending options to the agricultural sector include:

- Agriculture infrastructure

- Ancillary activities

- Farm credit, including short-term, medium-term, and long-term credit to farmers

Some of the agriculture loan options are listed below:

- Loans to individual farmers and proprietorship firms directly engaged in agricultural and allied activities, including fishery, dairy, animal husbandry, sericulture, bee-keeping and poultry;

- Loans to farmers managing traditional or non-traditional plantations, horticulture, and allied activities;

- Medium- and long-term loans to farmers for irrigation, funding the purchase of agricultural machinery and implements, and development loans for allied activities;

- Loans to farmers under the KCC (Kisan Credit Card) scheme;

- Loans to distressed farmers who are indebted to non-institutional lenders;

- Loans for watershed development and soil conservation;

- Loans for plant tissue culture, seed production, agro-biotechnology, facilitating the production of bio-pesticides, bio-fertilizer, and vermicomposting; and,

- Loans to facilitate the construction of storage facilities (such as warehouses, market yards, and silos) and cold storage units or cold storage chains specifically developed to shelve agricultural products.

So, it is clear that the priority sector lending option can work wonders for farmers in economic distress. However, the resolution to the existing challenges in agtech is incomplete without the incorporation of technology.

Challenges in Priority Sector Lending

One of the predicaments with PSL is that it imposes an economic strain on commercial banks. Farmers are prone to frequent losses due to market price fluctuations, extreme weather events, or crop loss due to pest infestations and diseases. When their payments are delayed or missed, banks classify the loan or the asset as NPAs (non-performing assets) since they cease to provide any return to the bank.

NPAs place a financial burden on these lending institutions in the following ways. Since RBI mandates that banks allocate PSL credit to sectors characterized by a comparably large number of defaults, a higher NPA ratio may signal to regulators that the financial fitness of the bank is in peril. The banks will then be obligated to set aside capital to account for the value of assets lost due to these NPAs, which invariably eats into the bank’s profitability.

PSL also involves other direct costs to the lending institutions. One among them is the transaction cost, comprising wages, salaries, printing, electricity, rent, and connectivity, in addition to insurance, the transportation of cash, overhead expenses, and depreciation, among others. In PSL, particularly for the agriculture sector, loans are low value and high volume, thereby increasing the transaction costs as many times.

Furthermore, the subsidized nature of priority sector loans, along with their already low rate of interest, forces banks to pay lower interest rates on retail deposits. Thus, it makes them less attractive investment options for people and eventually impacts the banks.

Agtechs in India: Establishing a Platform for Agro-Fintechs

India’s evolving agtech landscape is fertile, developing into an incubator for high-quality start-ups, thereby increasingly capturing investors’ interest. With several emerging only in the last five years, India graces the second position worldwide for the number of agtech service providers we have in the country.

If you take a broader look at the entire agri value chain, there are opportunities for fintech at almost every stage where agtech is involved. Here is a look at some of them.

- Farm management and data analytics: This includes remote sensing, drones, sensors and IoT, predictive modeling, traceability, and crop monitoring. Fintechs can leverage near-real-time intelligence to make data-backed lending decisions while minimizing risks. Farmer on-boarding and remote monitoring on a digital app, input-linked credit, and credit scoring are only a few examples.

- Livestock management: Much like with crop production, digital apps and alternate data allow easier identity verifications, faster loan processing, and effortless KCC (Kisan Credit Card) verification and renewals, among others.

- Agri-output marketplaces: They include demand aggregation, kirana or general stores, modern trade, and procurement from farmers and FPOs. Where agtech solutions help in inventory and supply chain management, financial institutions can benefit from the current and historical data to lend better, as in the case of warehouse financing.

- Novel farming: The rise of novel farming concepts like farming as a service, hardware, vertical farming, and hydroponics give both producers and financial institutions to explore the opportunity to expand their business and boost profitability.

- Agri-input marketplaces: This includes data-and-advisory-driven, direct-to-farm, channel-agnostic, and last-mile delivery of agri-input products and value-added solutions for marketing, logistics, distribution, and credit in the agri-inputs industry.

With so many positives around the Agri sector coupled with sufficient funding, what are the persisting hindrances in providing agricultural loans for small and medium farmers?

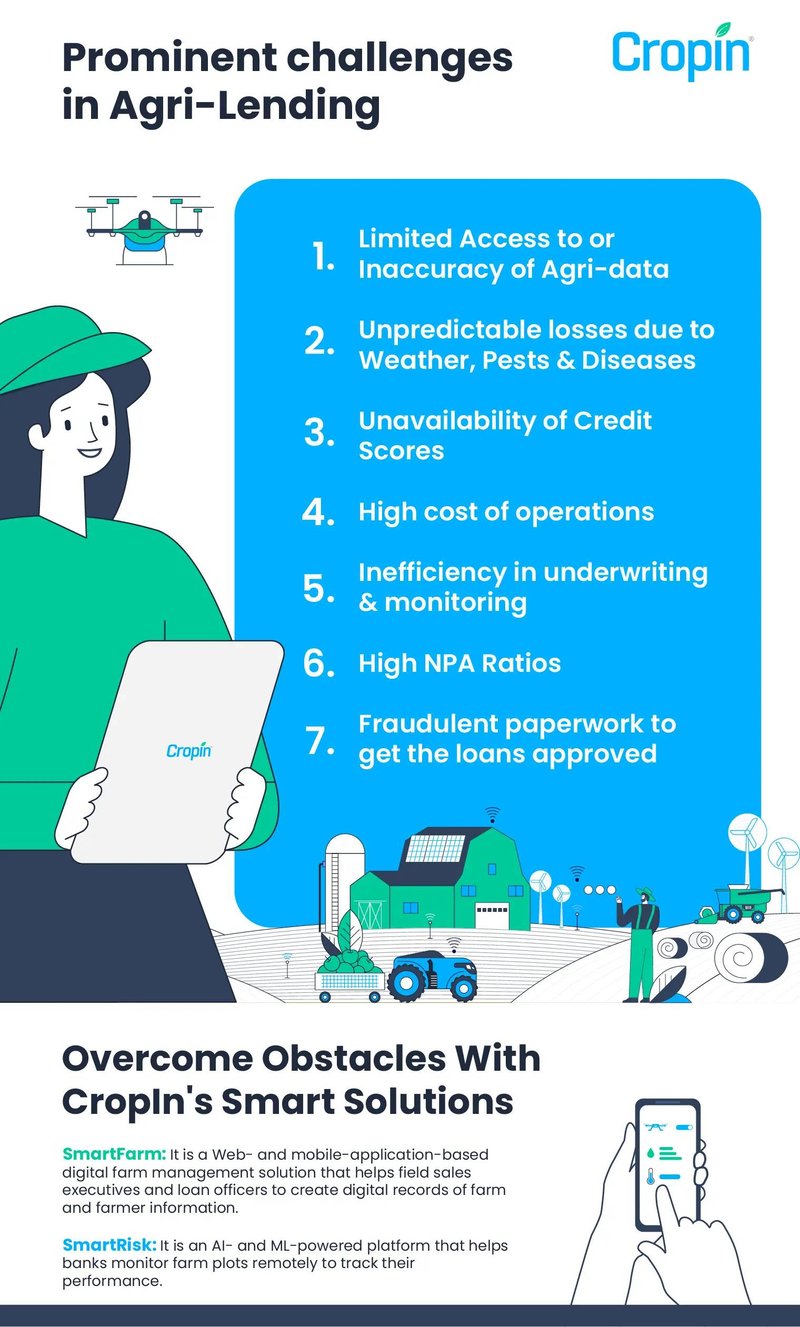

Most Prominent Challenges in Agri-Lending

Despite all the positives, there are still several challenges surrounding advancing crop loans. And, there are multiple layers to these challenges:

- Limited Access to or Inaccuracy of Agri-data

- Unpredictable losses due to Weather, Pests & Diseases

- Unavailability of Credit Scores

- High cost of operations

- Inefficiency in underwriting & monitoring

- High NPA Ratios

- Fraudulent paperwork to get the loans approved

Let us explore these in more detail now.

Challenge 1: Limited Access to or Inaccuracy of Agri-Data

Governments, banks, and fintech providers alike face challenges in accessing the agri-data of smallholder farmers. Besides, small or marginal farmers applying for loans often do not have the necessary documents to submit as proof, making it difficult for banks to validate the details they provide.

Technology helps ease such hurdles by delivering alternate agri-data that banks can use to appraise loan applications. It makes credit availability more accessible and convenient for small and medium farmers.

Challenge 2: Unpredictable Losses Due to Weather, Pests & Diseases

Farmers incur losses due to unpredictable factors that include extreme weather events, pest infestations, and crop diseases. Crop losses result in a low yield and not enough profits to allow timely loan repayment.

On the one hand, agtech solutions can warn producers of unfavorable conditions, enabling them to limit damage to their crops. On the other hand, banks can remotely monitor these farm plots and provide remedial advice to increase crop productivity and ensure a successful harvest.

Challenge 3: Unavailability of Credit Scores

Agriculture is a predominant occupation in rural areas, where farmers do not have adequate and timely access to financial services and have poor financial literacy. Most farmers do not have a bank account. Those who do have one do not fully use them. Without transactional records, banks have to rely on information self-reported by farmers, which may not be enough or accurate for credit scoring or to determine their repayment capacity.

Challenge 4: High Cost of Operations

As mentioned earlier, banks need to consider the transaction cost of delivering the credit to the borrower. Chief among them is sustaining a team of loan officers who visit farms to record information from farmers, either on paper or digitally. They then take this information to the bank for further evaluation and loan processing. This process places a heavy demand on the resources required for manual data collection and the time to collect, retrieve, and process the information. Additionally, bank officials will have to visit farmers to collect loan repayments, and with a lack of clarity on harvest windows, they may have to make multiple visits.

Challenge 5: Inefficiency in Underwriting & Monitoring

When banks underwrite loans, they assess whether or not the applicant meets eligibility criteria and the risk of lending money to them. Their income, credit score, and current debt and liabilities are crucial factors to consider during the process. Without adequate data or documents of proof, this becomes a tedious, drawn-out task.

Challenge 6: High NPA Ratios

As per the Financial Stability Report, December 2021, the gross NPA ratio of scheduled commercial banks for the agriculture sector was at 10.2% as of September 2021 (20% of the total GNPA in that period), a marginal increase from 9.8% in March the same year. One of the reasons for the high number of bad loans is that as banks try aggressively to meet the PSL target for the sector, the quality of loans takes a hit. Other concerns include willful default by the borrowers, misuse of funds, inefficiency of small farm operators, ignorance of beneficiaries regarding the terms and conditions or added benefits, lack of knowledge about scientific farming practices, low marketing skills, and low equity position of farmers.

In addition, crop failures due to droughts and heavy or delayed monsoons and not receiving insurance claim settlements to compensate for lost harvests, along with government policies of loan waivers, affected repayments, too. The supply disruptions caused by the COVID-19 pandemic in the sector further weakened the debt repayment capacity of farmers.

Challenge 7: Fraudulent Paperwork to Get the Loans Approved

From time to time, borrowers forged proposals based on bogus documents to avail crop loans intended for farmers. Without proper KYC verification, these loans amounting to several hundred crores are misused by the errant borrowers for non-agricultural purposes, instead of enabling farmers to purchase seeds, fertilizers, manure, machinery, tractors, pumps, harvesting, and transport crops.

Therefore, it is evident that there exists a striking gap between agriculture loan provisions and the availability of the same to the farmer.

So, is there a solution?

How Can Technology Help Overcome the Challenges in Agri-Lending?

Technology can play a tremendous role in simplifying and streamlining the otherwise unstructured process of agri-lending, wherein both the beneficiaries and the financial institutions can leverage collaborative growth. One of the pioneers in this field, Cropin, has facilitated the synergetic participation of all the primary stakeholders in a centralized and unique SaaS-based platform.

Advanced and powerful technologies such as AI/ML, deep learning, big data analytics, and satellite monitoring power this platform. Cropin offers end-to-end assistance to digitize operations for insurance companies and banks. In turn, this will help leverage alternative agri-data to drive predictability, thereby streamlining processes and making them smoother for financial institutions. Such digitization also brings down the cost of human efforts to ensure the completion of tasks on time.

Two of such revolutionary products from the house of Cropin are:

SmartFarm: It is a Web- and mobile-application-based digital farm management solution that helps field sales executives and loan officers to create digital records of farm and farmer information. Integrating this ground-level intelligence into a safe and secure cloud platform makes it easy for bank officials to review it almost immediately. They no longer have to wait hours together for the field staff to submit the forms physically post their field visits.

SmartRisk: It is an AI- and ML-powered platform that helps banks monitor farm plots remotely to track their performance. Further, this SaaS solution helps lending institutions to validate the information provided by farmers and compare it with available predictive and historical insights. SmartRisk also enables the institutions to identify areas under cultivation to help expand their business to previously unexplored regions. The data used by the platform to provide actionable insights are from multiple sources, such as satellite imagery and weather forecasts.

Agri-lending comes with its unique challenges. However, it is not impossible to resolve these either. With technology and agtech revolutionaries like Cropin, the journey becomes significantly easier.

How can lending institutions build a scalable & data-driven farm asset management system for priority sector lending?