Listen here:

Like many other developing countries, India relies extensively on its millions of smallholder farmers for its agricultural produce, be it food crops or cash crops. These farmers contribute immensely to the agriculture’s share of the country’s GDP and yet remain one of the most under-served and under-equipped communities across regions.

In an era when the world is embracing scientific advancements in agriculture and the adoption of modern technologies to make farming more productive and climate-resilient through the moderate use of available resources, small-scale and marginal farmers continue to gamble on age-old practices that are unsustainable and do not yield enough.

One of the most critical components to achieving a fruitful yield is adequate agricultural finance that helps farmers with their diverse needs such as purchasing and upkeep of farmland, investing in the right farm machinery and tools, buying quality inputs such as seeds and agrochemicals, and for crop insurance, too.

One of the ways farmers obtain financial support is through crop loans that banks provide specifically for agricultural purposes, which provides growers with the much-needed support to realize better agricultural productivity, especially when their previous harvest did not bring them an adequate income. Being reliable and highly organized institutions, banks provide one of the most feasible support to farmers who otherwise fall prey to local money lenders charging a much higher rate of interest.

What Are The Current Barriers To Disbursing High-Volume Low-Value Agricultural Finance?

Although the state and central governments are taking numerous measures to promote financial inclusion and ensure that farmers have adequate access to credit, banks have their fair share of challenges in assessing the creditworthiness of those applying for crop loans.

The current process of sourcing farmers to provide loans is extremely time-consuming and cumbersome. Field sales executives and/or loan officers are required to travel from one village to another to identify farmers who need loans, and lead generation this way can take at least up to 2 weeks. In addition, because this process of data collection is not yet digitized, filling forms manually can lead to loss of data.

It is a common practice to collect data from the farmer verbally, without enough evidence to verify the details provided for the loan applications. These details pertaining to their demographic, financial, and farm data, including the farmers’ personal details, the crops being cultivated, plot acreage, and yield estimations are vital to establishing the farmer’s creditworthiness, and enable banks to reduce the number of NPAs (non-performing assets). The lack of such reliable and structured data also means that the loan appraisal process can take many weeks to complete.

How can you determine the creditworthiness of a farm & farmer using AI? Learn more here.

After having disbursed the crop loans, banks have yet another colossal task of evaluating the performance of the farm plot periodically, which is at present accomplished by bank employees paying visits to farmlands every once in a while.

Not only is this cost- and time-consuming, but these visits prove futile when they are ill-equipped to provide advice or support to farmers to help achieve optimum yield, and ultimately this results in poor harvest and more NPAs.

According to an RBI report, the gross non-performing assets (GNPA) in the agri sector have soared to 8.44% as of March 2019, compared to nearly 2.5% five years ago.

Banks are also wary of providing loans to small-scale farmers as they are low-value and typically take loans that are ₹2 lakhs or even less. Many of these loans were waived off by the government in recent years due to the agrarian distress that led to thousands of farmers taking their lives when they couldn’t repay their debts.

Besides, unlike in other countries, banks in India are unable to exercise differentiated pricing for loans for each farmer based on their credit profile and commodity, which makes it even more difficult to hedge risks.

Smallholder farmers typically take loans that are ₹2 lakhs or even less. However, a report from the RBI data disclosed that in FY 2017, only 40% of the total agri-credit was ₹2 lakh or less. Nearly 47% of the total was, on the other hand, loans that were each between ₹2 lakh and ₹1 crore, and the remaining 13% included loans of ₹1 crore or more. Of the 210 individuals and entities that received the seal of approval for loans over ₹100 crores at a subsidized 4% rate of interest, a significant number were authorized for fertilizer and farm-equipment manufacturers, warehouses and cold storage owners, and various food processors.

Source: The Hindu Business Line

How Is Cropin’s AI-Led Solution Reinventing Credit Underwriting And NPA Management?

In an effort to simplify the unstructured process of agri-lending for both financial institutions and the beneficiaries, Cropin enables the collaborative participation of all the key stakeholders on a unique, centralized platform that is powered by advanced technologies including artificial intelligence, machine learning, satellite monitoring, and cloud computing.

Cropin helps digitalize end-to-end operations for banks and insurance companies and leverage alternative agri-data to drive predictability and make business operations easier for financial institutions. This digitalization also significantly cuts down hours of human effort required to accomplish some of the tasks that can otherwise be automated or optimised using technology.

SmartFarm is Cropin’s digital farm management solution that enables loan officers and field sales executives to collect accurate and verified farmer and plot information using their smartphones. This ground-level intelligence is made available in a secure cloud platform, which can be accessed by bank officials almost immediately, without having to wait for loan officers to physically submit the forms for approval upon return from field visits. The digitized data, along with easy-to-integrate APIs, also ensures hassle-free analysis and reporting of the agricultural loan portfolios as and when required.

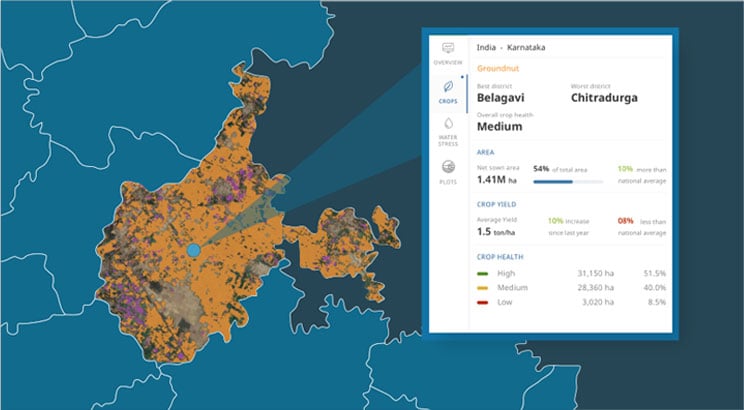

Banks can also leverage Cropin’s AI/ML-powered platform SmartRisk to identify areas that are under cultivation and expand their business to previously unexplored regions.

SmartRisk further enables lending institutions to validate the information furnished by farmers by comparing it with historical and predictive insights gleaned from a combination of data from multiple sources, including the platform’s global agri-ground intelligence, weather, and satellite imagery. The platform establishes the performance of every pixel to deliver region-level (farm/district/postcode/state/country) and plot-level insights at a fraction of the traditional cost and effort. It allows banks to underwrite loans and process credit to those farmers who display high assurance of loan repayment.

Following loan disbursal, banks can remotely keep an eye on the performance of farm plots, as Cropin’s proprietary algorithms enable not only accurate crop detection but also crop growth and crop stage analysis at regular intervals. This aids financial institutions in identifying the approximate time of harvest, to enable timely recovery of the loan and better management of delinquencies.

In the case of credit disbursed in tranches, banks can also monitor if the funds have been used for the purpose stated by the farmer. Any unanticipated change in the plot will be alerted through smart notifications to enable timely action by the bank. It also ensures hassle-free analysis and reporting as and when required.

The recent advancements in technology offer a myriad of opportunities for better and efficient financial inclusivity in both developed and developing nations around the globe Cropin’s robust solution with its intelligent application of modern technologies capacitate lending institutions to raise the bar and achieve more by leveraging alternate data for high-volume, low-value agri-portfolios minus the many risks and uncertainties involved in the process.

Learn how AI-led agriculture can help you with efficient pre-and-post-disbursal of loans.