Navigating the agri-insurance landscape

Biggest challenges in agri-insurance

Premium estimation and portfolio management:

Data limitations: The sheer volume of agricultural data can be overwhelming. A study by the World Bank Group estimates that about 4.1 million data points per farm per day will be produced by 2050. However, insurers often struggle to access and utilize both historical and real-time data and the insights it can unlock, compromising accurate portfolio management and premium estimation.

Assessing future regional risks:

Uncertainty in regional crop viability: Climate change impacts established food production zones, leading to uncertainties in crop suitability and yield prediction, which impact underwriting and long-term risk planning.

Risk forecasting: Insurance companies often lack comprehensive data on how climate change and unprecedented weather events will affect different regions. This hinders underwriting, accurate risk forecasting, and the development of effective risk management strategies.

Risk mitigation and disease early warnings:

In-Season performance monitoring and claim validation:

Climate change: Climate change is a significant challenge facing the agri-insurance industry. With the increasing unpredictability of weather patterns impacting yield, insurance claims are on the rise. Validation of these claims requires real-time monitoring of every insured plot in-season.

Data inconsistencies & delays: Relying solely on manual reports, especially from remote areas, can lead to delays, inaccuracies, and increased susceptibility to fraudulent claims. It impacts in-season performance monitoring, slows validation, increases claim processing time, and delays settlements.

Self-reported data discrepancies: Farmers may provide inaccurate or exaggerated self-reported data. This must be verified, which is time-consuming and prone to fraud when done manually. Cross-verification without technology-backed tools like satellite imagery is almost impossible.

Cropin’s innovative data-driven solution for Agri-insurance

Key benefits of cropin’s solutions for agri-insurance

Crop suitability & crop acreage estimation:

Crop identification:

Enhanced data access:

Real-time monitoring:

Accurate crop health assessment:

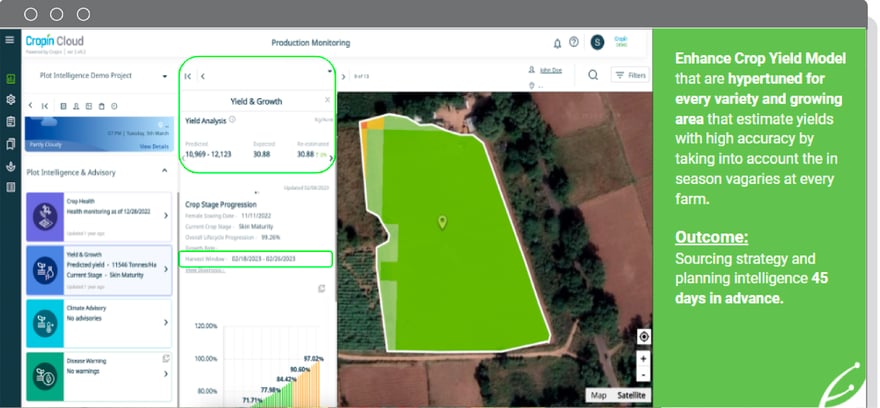

Crop growth progression & harvest window estimation:

Water stress identification:

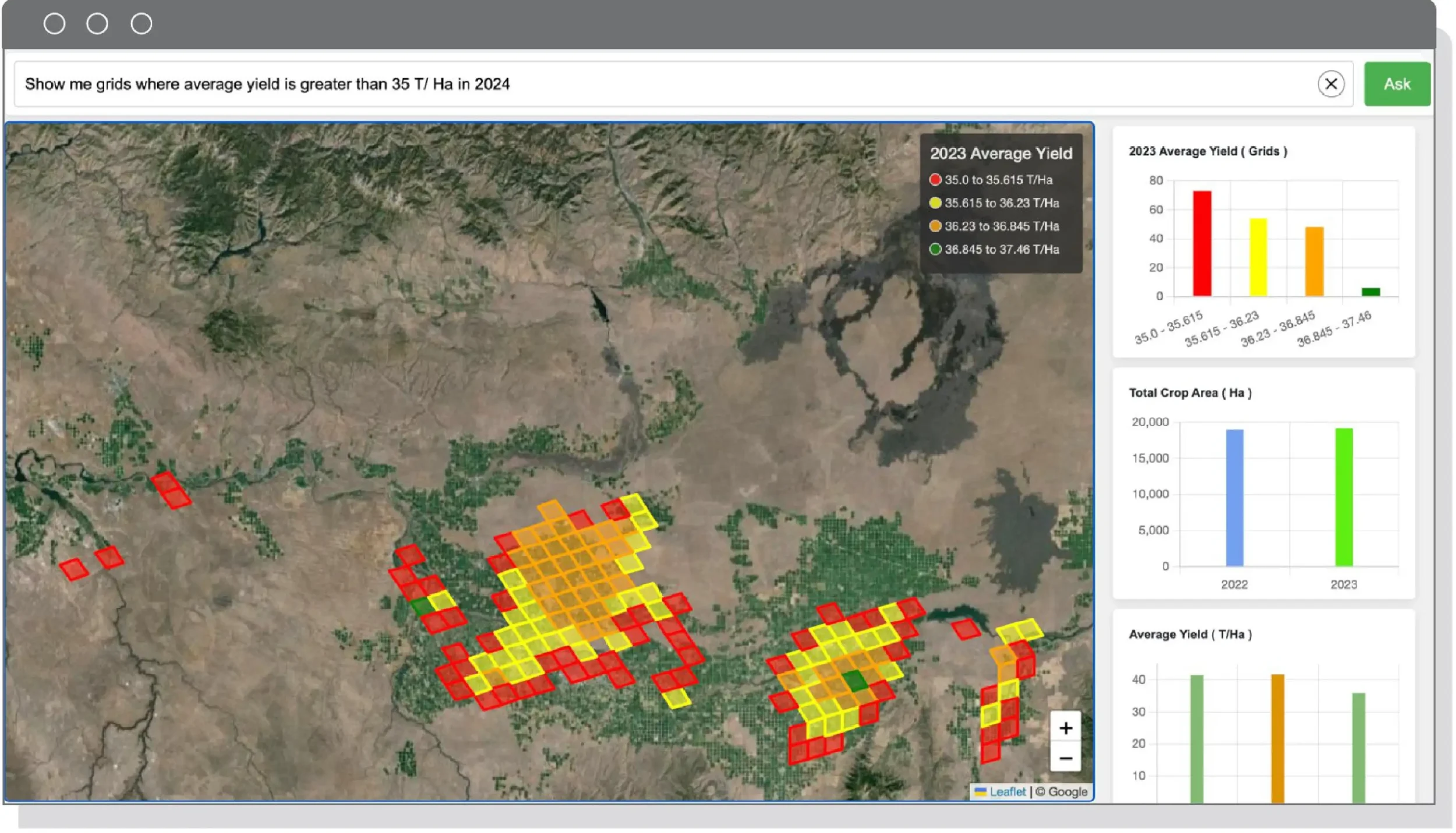

Yield estimation:

Weather updates and disease early warning system(DEWS):

Farmer engagement:

With Cropin, you can directly engage with farmers in their local language and share timely alerts on possible pest threats, hyper-local weather conditions, critical agronomic practices, and predictive data-driven intelligence. The alerts and notifications can be disseminated across multiple communication channels—email, SMS, WhatsApp, and Mobile Apps. This is vital to safeguard yield and optimize payouts.

Cropin sage: time travel to the future

Benefits agri-insurance professionals can get out of cropin cloud

- Enhanced Risk Assessment: Accurately assess crop suitability, estimate regional risks, and identify potential challenges using our advanced analytics.

- Efficient Claim Processing: Validate claims and reduce errors of manual inspections.

- Accurate Damage Assessment: Assess crop damage and estimate losses more precisely.

- Proactive Risk Management: Offer timely alerts about potential disease with DEWS and take proactive mitigation measures.

- Improved Decision Making: Make informed decisions based on accurate crop identification and real-time data.

- Enhanced Data Access: Gain access to data multiverse, including area audits, remote monitoring, weather patterns, soil analysis, satellite imagery, and historical crop yields to feed into your risk assessment models.

- Improved Accuracy of Yield Estimation: Accurately and non-invasively predict crop yields based on a comprehensive dataset and advanced modeling.

- Farmer Engagement: Communicate directly with farmers to share valuable insights and support.