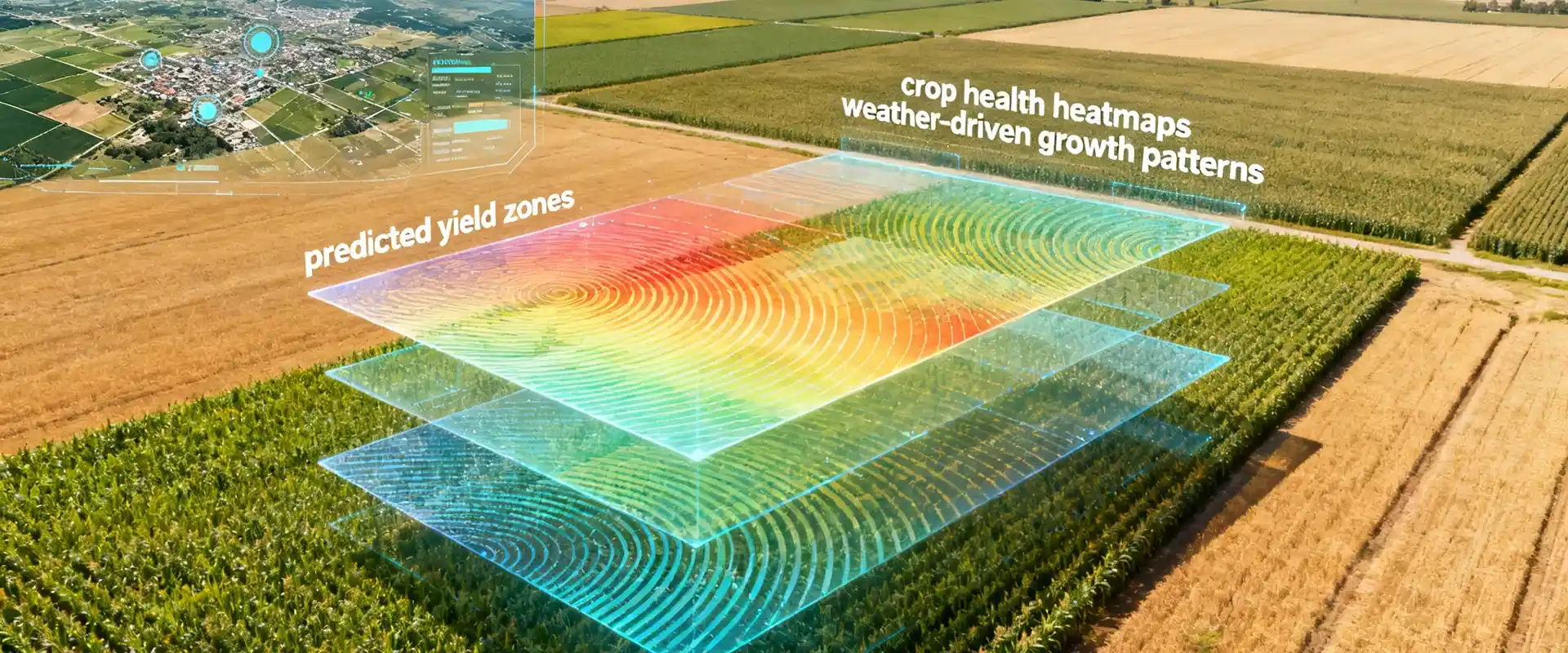

Insights that cultivate tomorrow’s agriculture

Discover expert knowledge, real-world applications, and the future of farming through AI, data, and digital innovation.

Featured blogs

All blogs

No posts found

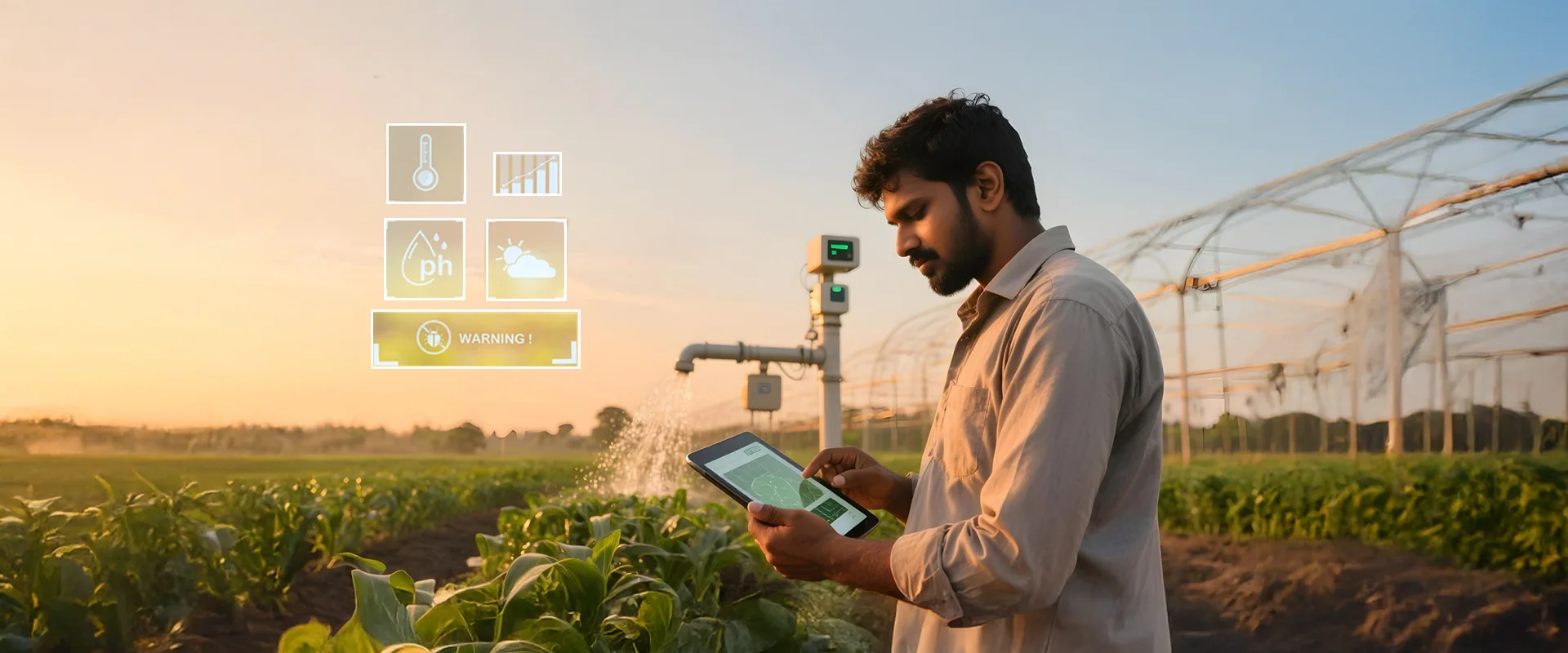

Transform your farm operations with Cropin Cloud

Experience the future of agriculture with Cropin Intelligence. Sign-up for early access, and we will connect with you shortly on the next steps.